One of the biggest topics of the year, and most long-awaited development for the hospitality industry, is the anticipation for a change in interest rates. It has been the most talked about topic all year, with many expecting it to have happened already. A few key factors point to a possibility of the Fed making some movements and adjustments as soon as this month.

The Current Outlook

So far, this year has been a lot closer to the patterns of 2019 and before. With so much pent-up demand for travel lasting the past few years, we are finally seeing a return to previous patterns, and bringing back some predictability.

The group sector is out performing the leisure sector, and companies have lowered their RevPAR growth guidance to 1.0%-2.0% from 2.3%-4.3% (according to a recent report from hotelAve). Leisure demand is expected to continue to level out, but overall we’re still seeing growth and numbers higher overall than pre-pandemic.

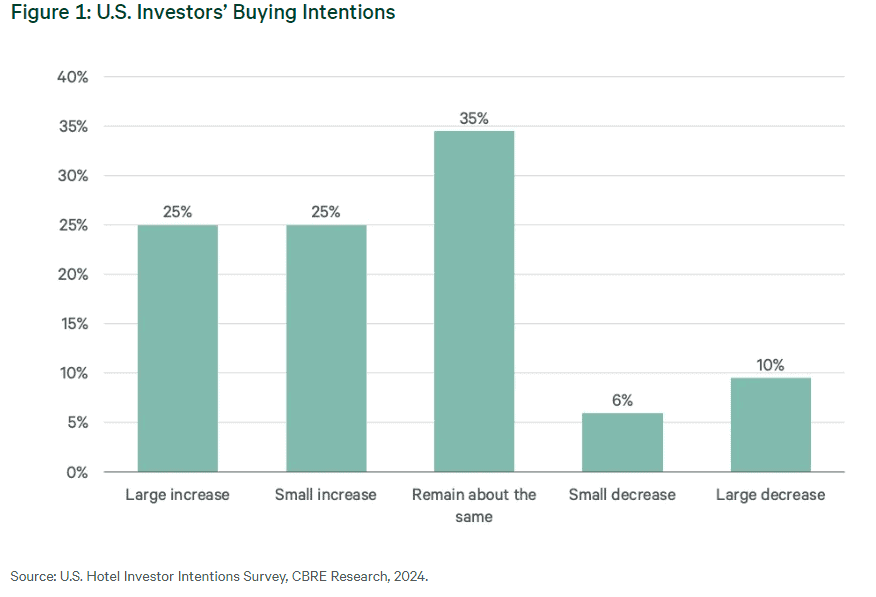

More than half of investors surveyed are planning to increase their hotel investments, according to a CBRE survey released back in May.

Understanding the Shift Towards Lower Investment Rates

Investment rates in the hospitality industry are influenced by a myriad of factors, including economic conditions, interest rates, and market demand. Lower investment rates typically signal a decrease in the cost of capital, making it more affordable for businesses to fund new projects or refurbish existing properties. For the hospitality sector, this could have several far-reaching implications.

For Investors

1. Enhanced Opportunities for Expansion

Lower investment rates can open doors for investors to fund new hotel developments or acquisitions at a reduced cost. This can be particularly attractive in a market where high-quality assets are scarce. Investors might find opportunities to diversify their portfolios with hospitality assets that were previously out of reach due to high financing costs.

2. Increased Competition

As financing becomes more accessible, more investors may enter the market, leading to heightened competition. This could drive up property prices, potentially offsetting some of the benefits of lower investment rates. Investors will need to be strategic in their approach, focusing on high-yield opportunities and conducting thorough due diligence.

3. Improved Return on Investment (ROI)

With reduced financing costs, the potential for higher returns on investment increases. Investors can benefit from improved cash flow and profitability as the cost of capital decreases. However, they must remain vigilant about other factors such as market conditions and operational efficiencies to fully capitalize on these opportunities.

For Hotel Owners

1. Opportunities for Renovation and Expansion

For hotel owners, lower investment rates mean greater access to capital for renovations and expansions. Upgrading facilities or expanding operations can enhance property value and attract more guests. This could be especially beneficial in a competitive market where differentiation is key to attracting high-value customers.

2. Refinancing Benefits

Existing hotel owners with current loans may benefit from refinancing at lower rates, reducing their debt servicing costs and improving overall financial stability. This can free up resources for reinvestment into the property or other strategic initiatives.

3. Market Risks

While lower investment rates present opportunities, hotel owners must also be aware of market risks. Increased competition from new entrants and potential shifts in consumer preferences can impact profitability. A strategic approach to leveraging lower rates while managing market risks is crucial.

For REITs

1. Enhanced Acquisition Potential

Real Estate Investment Trusts (REITs) can capitalize on lower investment rates by acquiring new hospitality assets at more favorable financing terms. This can support growth strategies and improve portfolio diversification. REITs may find it easier to pursue acquisitions in both emerging and established markets.

2. Impact on Valuations

Lower investment rates can lead to higher property valuations as the cost of capital decreases. This can be advantageous for REITs looking to enhance their asset base. However, it is important to balance acquisition strategies with a thorough analysis of asset quality and market conditions.

3. Distribution Adjustments

With reduced borrowing costs and improved cash flow, REITs may be in a position to increase distributions to shareholders. This could enhance the appeal of REIT investments to income-focused investors. Nevertheless, REITs must ensure that they maintain a sustainable distribution policy while pursuing growth opportunities.

Conclusion

The prospect of lower investment rates in the hospitality industry presents both opportunities and challenges for investors, hotel owners, and REITs. While the potential for enhanced returns, expanded acquisition opportunities, and improved financial stability is promising, stakeholders must remain cautious of market dynamics and competitive pressures.

For investors, the key will be to navigate the increased competition and identify high-value opportunities. Hotel owners should focus on leveraging lower rates for renovations and refinancing while staying attuned to market risks. REITs must strategically acquire assets and manage distributions to maximize shareholder value.

There is still a lot of talk regarding asset transactions, and backlog of PIP schedules, but still some hesitation waiting for any sort of movement in the interest rates. But once that interest rate lowers, many investors are ready to make those deals, and move forward with their hospitality transactions. The demand for renovation and procurement services may increase drastically and affect lead times and costs.

If you know you are close to starting a new construction project or renovation, and would like to talk to a purchasing agent about what you can do to get ahead of the rush, we’d love to help. Securing pricing and timelines as much as possible could be an important part of meeting deadlines and budget goals in the coming months.

As the hospitality industry adapts to these changing investment conditions, staying informed and agile will be crucial for success in this evolving landscape.